Analysis: IEA’s renewables forecast grows 76% in two years after ‘largest ever’ revision

Josh Gabbatiss

12.06.22Josh Gabbatiss

06.12.2022 | 4:06pmThe International Energy Agency (IEA) has raised its global forecast for renewables growth in what it calls its “largest ever upward revision” for the sector.

The latest revision means the agency now forecasts 76% more growth than it did just two years ago, Carbon Brief analysis shows.

This means extra wind, solar and other renewable technologies equivalent to the entire electricity system of India being built by 2026, on top of last year’s projections.

The agency says this year’s forecast accounts for a wave of new policies introduced largely in response to Russia’s invasion of Ukraine and soaring fossil fuel prices.

The IEA’s latest annual report on the status of renewables notes that the global energy crisis is “pushing the accelerator on renewable energy expansion”, particularly in the EU, US, China and India. It says utility-scale solar and onshore wind power are now the cheapest options for new generation in “a significant majority of countries worldwide”.

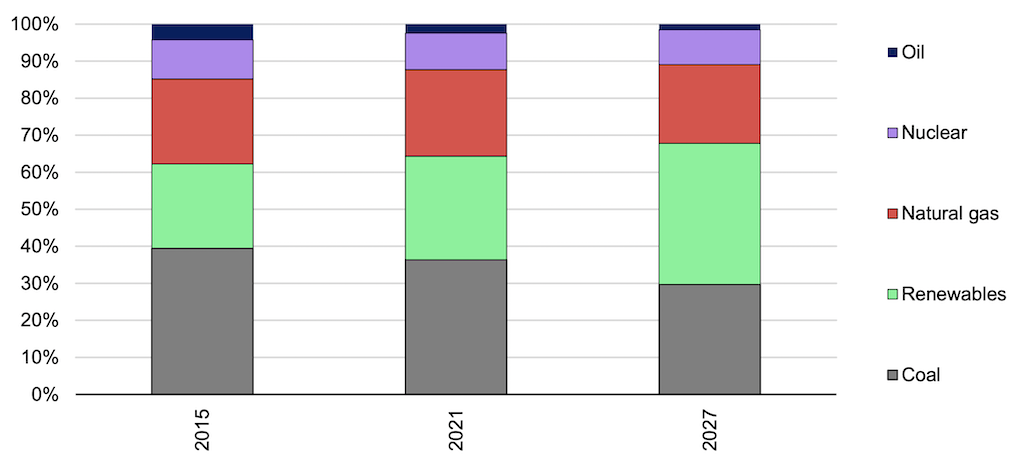

The influential Paris-based agency now expects renewables to surpass coal as the largest source of electricity generation by “early 2025”, reaching 38% of the power mix by 2027. The installed capacity of solar power alone is set to overtake that of coal in 2027.

But, despite this increase in global ambition, the IEA says countries are still not on track to achieve a net-zero emissions energy system by 2050. It highlights how addressing regulatory and financial barriers could “significantly narrow the gap” to achieving this target.

Extra capacity

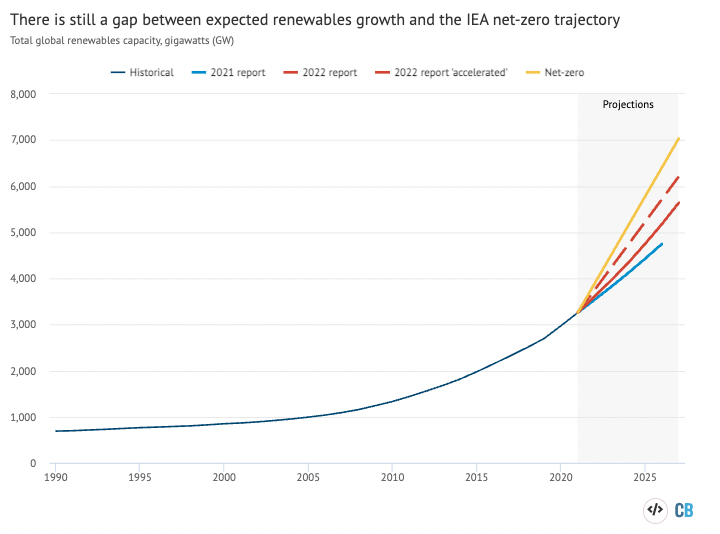

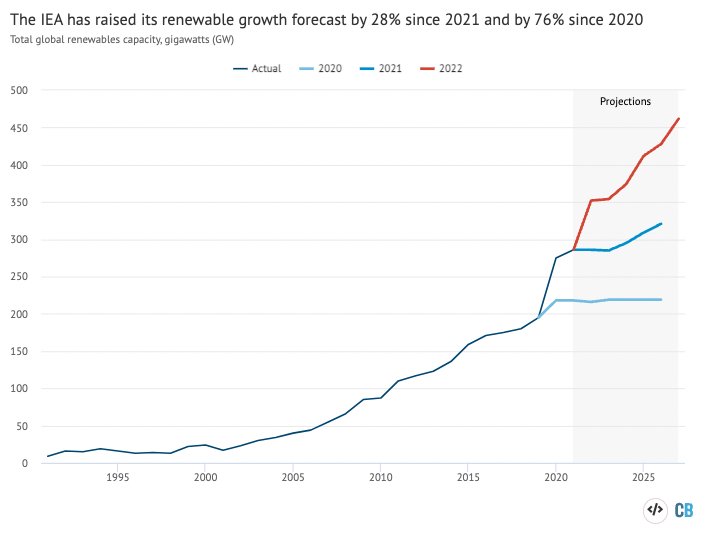

In its 2020 renewables report, the IEA forecast an additional 1,092 gigawatts (GW) of global capacity would be built between 2022 and 2026. It raised this to 1,496GW last year.

For the main scenario in its latest report, the agency estimates that an extra 424GW of renewables capacity will now be built over this five-year period, roughly equivalent to the entire power capacity of India. This is a 28% increase on the previous estimate and up 76% from two years ago.

Combined with the extra year that the IEA includes in its latest analysis, this brings the total additions by the end of 2027 to 2,383GW – around the total power capacity of China.

The difference between the three projections can be seen in the chart below. The black line shows historical growth, while the light and dark blue lines show the estimates of annual renewable capacity additions from the 2020 and 2021 reports, respectively. The red line shows the same estimates from the 2022 report.

The report attributed this “largest ever upward revision of IEA’s renewable power forecast” to energy security concerns and new policies resulting from “the first truly global energy crisis”. It states:

“First, high fossil fuel and electricity prices resulting from the global energy crisis have made renewable power technologies much more economically attractive, and, second, Russia’s invasion of Ukraine has caused fossil fuel importers, especially in Europe, to increasingly value the energy security benefits of renewable energy.”

The most consequential policies have been implemented in the EU, US, China and India.

China alone is expected to build almost half of new global renewable power capacity between 2022 and 2027. The IEA has revised its estimate for the country’s renewable construction upwards by 35%, following its 14th Five-Year Plan on renewable energy.

The IEA forecast for renewable growth in the EU is 30% higher than last year’s report, bolstered by strong plans in Germany, which has a 50% higher projection, and Spain, which has a 60% higher projection.

The bloc has planned to stop relying on gas imports from Russia with its REPowerEU strategy, which includes increasing its share of renewables.

However, the IEA’s forecast in its main scenario is not in line with the EU’s ambitions, as the report notes the need for “policy improvements” from more member states.

The Inflation Reduction Act in the US and the Indian government’s competitive auctions launched to achieve the target of 500GW of non-fossil fuel capacity by 2030 also lead to increases on previous estimates.

Overtaking fossil fuels

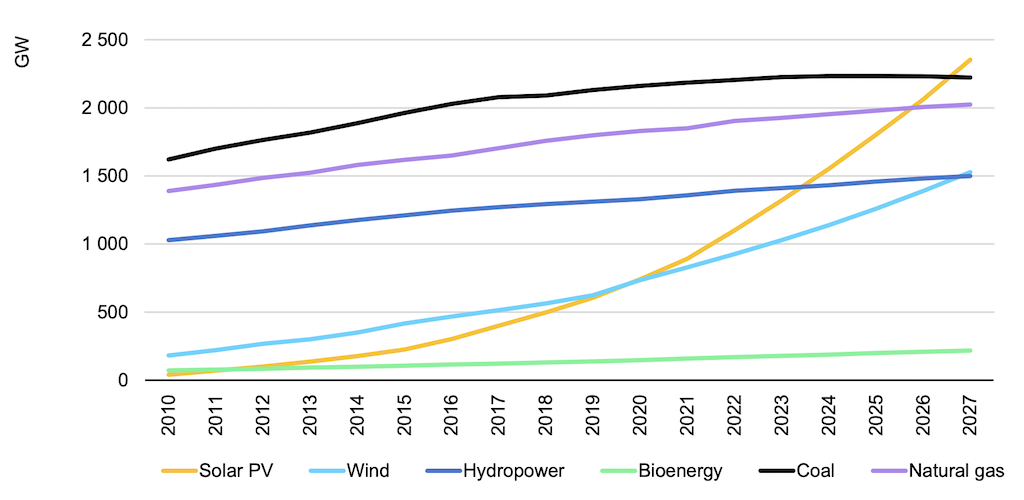

As the chart below shows, the IEA expects solar capacity to overtake all other sources of electricity over the next five years. Hydropower will fall from the largest renewable by installed capacity to the third-largest, it says, due to increases in both solar and wind capacity.

Solar power will overtake gas by installed capacity in 2026 and coal in 2027, under the IEA’s main case forecast.

As for the actual generation of electricity, the share of renewables, including wind, solar, hydropower, bioenergy and others, in global electricity generation reached 28.7% in 2021. Their share of the power mix is now forecast to increase to 38% by 2027.

The report estimates that renewables will overtake coal to become the largest source of electricity generation by early 2025, and wind and solar will provide one-fifth of generation by 2027. This increase – edging out both coal and oil as power sources – can be seen in the charts below.

Despite this increase over the next five years, the new increase in renewables is still not aligned with the IEA’s updated net-zero scenario, which sees renewables producing 61% of all electricity by 2030.

Not net-zero

The rate of renewable capacity expansion would need to be even faster than the main scenario laid out in the new report, to be in line with the IEA’s net-zero scenario by 2050.

For the 2022-2027 period assessed in the new report, the net-zero scenario would require an additional 1,394GW of additional renewable capacity to be constructed, bringing the total to 3,777GW.

The report includes an “accelerated” scenario, where renewable capacity grows more quickly than in the main case due to policies and other measures that are not currently in the works. This “would significantly narrow the gap” to the net-zero pathway, bringing the total capacity to 2950GW by 2027, the IEA says.

This can be seen in the chart below. Estimates for future cumulative renewables capacity in the 2022 report (red) versus the 2021 report (dark blue) are shown, as well as the upwards push in the accelerated case (red dotted) which bring the pathway closer to a net-zero compliant one (yellow).

The additional measures required for the accelerated case involve governments addressing “policy, regulatory, permitting and financing challenges”, according to the report.

In advanced economies, the main issues highlighted are permitting and grid infrastructure expansion. The IEA says that the EU has the largest additional potential of any region, capable of adding more than 30% additional capacity if member states resolve such “pre-existing deployment challenges”.

For emerging economies, the report states that “policy and regulatory uncertainties still remain major barriers to faster renewable energy expansion”.

However, it notes that even in the main scenario, China is already on track to reach its 2030 target of 1,200GW of wind-and-solar capacity five years early.

In developing countries, the barriers to a faster rollout to renewables are lack of access to affordable financing and weak grid infrastructure.

-

Analysis: IEA’s renewables forecast grows 76% in two years after ‘largest ever’ revision