Analysis: IEA World Energy Outlook sees radical shifts, despite conservatism

Simon Evans

11.11.15Simon Evans

11.11.2015 | 5:02pmThe next 25 years will see a radical shift towards renewables and away from coal, a global energy centre of gravity pivoting towards India and the prospect of Africa leapfrogging dirty energy.

These are some of the insights touted by the International Energy Agency (IEA) World Energy Outlook 2015, published this week.

The annual outlook, weighing in at 700 pages, is one of the most widely-read and universally respected set of energy-related forecasts in the world. Yet it’s important to remember it remains just that: a forecast, reflecting a complex set of economic and energy-cost assumptions.

Carbon Brief reviews some of the conservative assumptions that lie behind the outlook’s findings.

China is slowing down

One of the most dramatic shifts seen in this year’s outlook is the slowdown in China, in particular for coal. Now the world’s largest emitter, China is responsible for burning half of all coal after year-on-year growth in coal use that approached 10% throughout the 2000s.

Dr Fatih Birol, IEA chief executive says:

We are approaching the end of the single largest demand growth story in energy history…We see a decoupling of GDP and energy demand [in China].

China’s coal use has now “all but reached a plateau”, the outlook says, arriving around five years earlier than thought in last year’s outlook. The plateau is a mixture of small increases in coal use for electricity generation combined with a large 35% fall in industrial use out to 2040.

The IEA has also significantly reduced its Chinese energy demand forecast to 2040, cumulatively knocking off as much as two years’ current US energy demand. Some 90% of this is due to lower coal use, it says, adding that recent statistical revisions would knock another 2% off coal in 2040.

The outlook says that “the engine of growth [is moving] away from heavy industries”, that old and inefficient coal-fired power capacity is being canned — alongside the construction of new, more efficient coal plants — and that China’s renewables capacity will equal the US and EU combined.

It also notes falling Chinese coal use last year. Yet it disagrees with “some market observers”, who see a continued decline in coming years. Only a “dramatic slowdown” in GDP growth or an “unprecedented pace” of economic restructuring could trigger sustained coal reductions, it says.

Workers sort out waste rocks from coal on a belt conveyer at a coal mine in Huaibei city, east China’s Anhui province, 12 May 2015. © Imaginechina/Corbis.

Is this too conservative? Recent data suggests coal use continued to decline through 2015, on accelerating falls in power production, a sluggish economy and growth of cleaner alternatives.

It’s worth noting, then, that the IEA assumes China will be years late in meeting its clean energy goals. By 2020, China has targets for 420 gigawatts (GW) of hydro capacity and 220GW of wind. The IEA expects these goals to be met seven years late for hydro, and two years late for wind.

This reflects another conservative IEA assumption. Its central “New Policies Scenario” includes policies, such as the climate pledges submitted to the UN, even if they are yet to be enacted. However, it takes a “generally cautious view” of when, or even whether this will actually happen.

Speaking to Carbon Brief earlier this year, Birol left open the possibility of more rapid progress in China. If the outlook is wrong and China cuts coal use while meeting its climate targets — it has a strong record here — then the consequences would reverberate through the global coal industry.

The outlook says:

Contemplating such a decline in China’s coal use is an uncomfortable process for the coal industry. The consequences would be dramatic…[with] intense competition for customers and rock-bottom prices. Low prices could offer an incentive for additional consumption elsewhere, but not anything like the scale that could fill the gap left by China, given its weight in global coal demand.

India takes centre stage

Long thought to be the prime candidate to take China’s place, this year’s outlook has a special focus on India. Birol explains:

India will be the engine of global energy demand growth…India is moving to the centre stage of the world of energy.

By 2040, energy demand in India will be about as large as in the US, Birol says, and it will account for a quarter of the rise in global energy demand in that period. Yet per capita demand will remain at perhaps 40% of the global average.

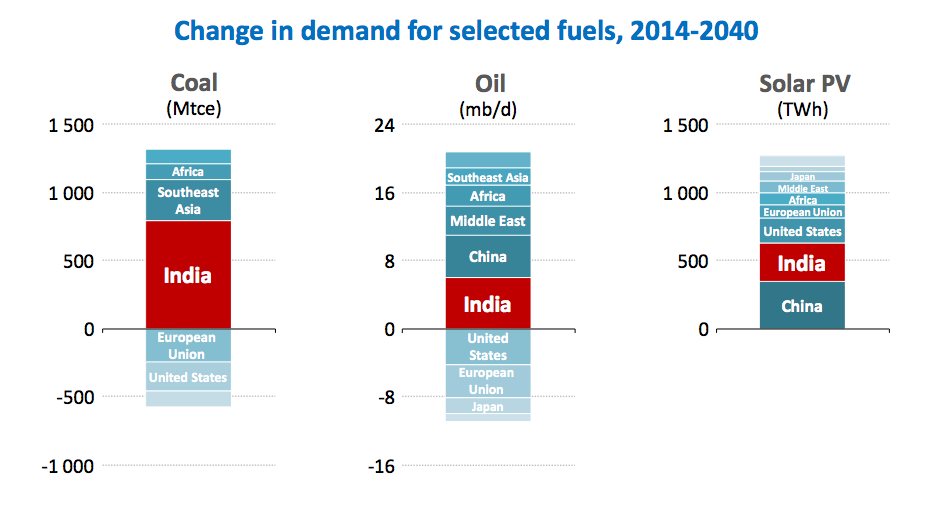

India’s significance is illustrated in the chart below, which shows it taking nearly three-fifths of the increase in coal demand between now and 2040, along with around a quarter of oil and solar.

Change in demand for coal, oil and solar energy between 2014 and 2040. Left to right: coal demand in millions of tonnes of coal equivalent; oil demand in millions of barrels per day; solar PV output in terawatt hours. Source: IEA World Energy Outlook 2015, presentation to the press.

It’s worth repeating, as noted above, that the growth in India’s demand for coal is not expected to match the increase in China during the 2000s. India has “significantly fewer” domestic coal resources, the IEA notes.

More importantly, countervailing forces are at work, the IEA says, including downward pressure on natural gas prices and “notable cost reductions in many renewable energy technologies”. These factors could limit expected increases in India’s appetite for coal, the IEA suggests.

The rise of India as an energy power is built on strong GDP growth expectations, a rising population and the drive to bring electricity to the 240m Indians without.

The IEA also says that revisions to India’s official GDP data have boosted the size of its economy, and, therefore, its future growth prospects and energy needs. This shows up in Indian electricity demand in 2040, which is forecast to be 9% higher than thought last year. Under an “Indian Vision” scenario where the government’s goals are met, electricity demand in 2040 would be lower.

As with China, however, the outlook assumes India will miss many of its climate policy goals. The ambitious Indian target for 100GW of solar in 2022 will be hit eight years late in 2030, the IEA forecasts, and it sees India achieving less than half of its goal for 63GW of nuclear by 2032.

The outlook notes:

There is upside potential [for Indian solar] as well as downside risk to our projection: what is unarguable is that India’s solar targets…[make] a powerful statement of intent that solar power shall be a new and potentially transformative technology in India’s energy mix.

Renewables take top spot

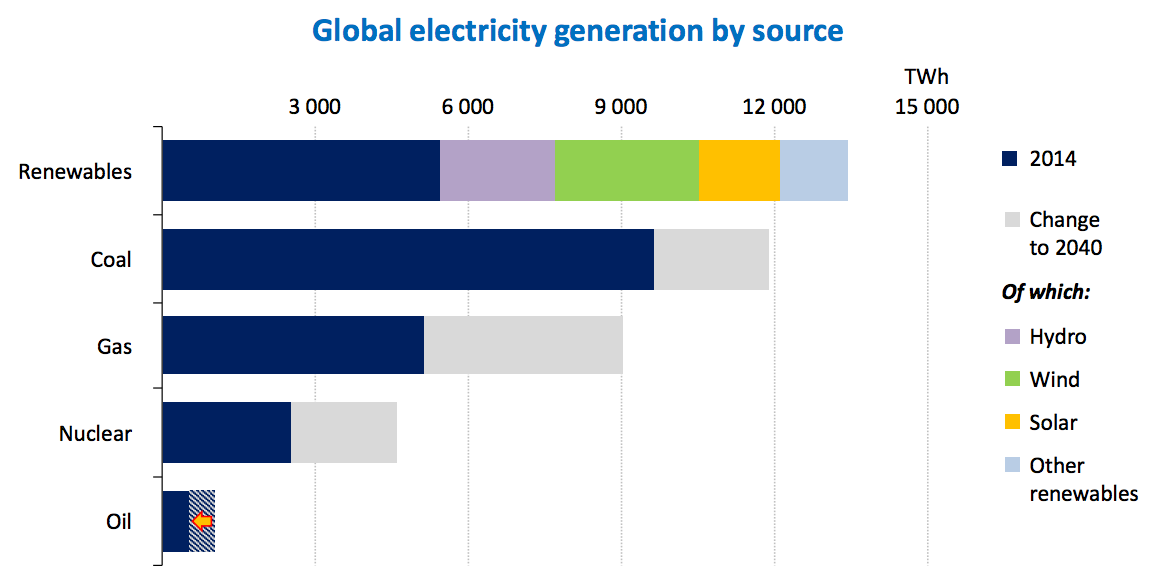

Despite apparently conservative assumptions about countries’ chances of meeting their clean energy goals, the IEA still sees renewables overtaking coal to become the world’s number one source of electricity in the “early 2030s”.

“Renewable energy is no longer a niche fuel,” Birol says, and 60c in every $1 invested in energy over the next 25 years go into renewables. Where growth in recent years has been driven by hydroelectricity, in the years to come wind and solar will lead the way, Birol says.

You can see this shift in the chart below, which shows the growing role for wind and solar.

Global electricity generation by source in 2014 (terawatt hours, dark blue bars) and change to 2040 (grey, lilac, green, yellow and light blue bars). Source: IEA World Energy Outlook 2015, presentation to the press.

Beneath this positive outlook for renewables, however, there are again conservative assumptions. The IEA sees solar costs falling by around 40% between 2014 and 2040, and onshore wind around 15%.

Commenting on the solar figure Michael Liebreich, founder of Bloomberg New Energy Finance, tells Carbon Brief:

[That] seems very conservative. [It] would imply just two more [capacity] doublings in 25 years – for a sector currently growing 30% per year.

There is a broadly accepted rule known as Swanson’s Law, which says that the cost of solar falls by a fifth every time installed capacity doubles. At 30% annual growth, solar capacity would double within three years and double again well before 2020.

Combining this 30% per year growth with Swanson’s Law implies the cost of solar should halve by the early 2020s — much more rapidly than the IEA seems to assume.

It’s worth being cautious before taking this argument too far, not least because Swanson’s Law applies to the cost of solar panels rather than a fully-functioning, installed solar system.

On the other hand, analysts at Deutsche Bank expect installed solar system costs to fall by 40% in the three years from the end of 2014 to the end of 2017.

The IEA has been roundly criticised for consistently underestimating wind and solar. Successive world energy outlooks have forecast linear growth at, or below recent levels. This year’s outlook follows the pattern, forecasting 34GW of new solar each year to 2040 and 40-45GW of wind.

This appears at odds with history, where solar capacity grew by 40GW in 2014 and the rate of growth has averaged nearly 50% over the past decade. For wind, 52GW was added in 2014 and average growth in the previous decade was 23% year on year.

Each year, the IEA’s forecasts have been revised upwards. Again, the 2015 outlook fits this mould, projecting 10-20% more solar through 2040, and around 5% more wind, than the IEA expected a year ago. Yet the expected growth rates remain linear.

A recent post from Vox’s David Roberts looks at what has been going on, with institutional conservatism at the IEA coming out as one key factor. The IEA’s apparently conservative cost reduction projections for wind and solar are clearly another.

Africa could leapfrog coal

Throughout the latest outlook, the IEA offers glimpses of optimism for climate action tempered by its inherent conservatism. Another shining example is its expectations for Africa.

Birol says:

Something may happen for the first time and I am very excited…In Africa we may well see, for the first time, we may see a region realising its growth on the basis of renewables.

Birol contrasts this to the world’s existing major economies in the EU, US and China that have all built economic growth using the power of coal. As set out in a recent Economist article, this raises the prospect of Africa effectively leapfrogging towards clean energy supplies.

The IEA’s outlook aligns in broad terms with the African Development Bank’s vision to electrify the continent through a focus on renewables, yet it places a far heavier emphasis on natural gas. Again, this reflects its underlying assumptions about the future, relative cost of renewables.

The development bank’s president, Akinwumi A. Adesina, does not rule out an important role for fossil fuels, but he calls for a “renewables revolution” and says there is potential for 11 terawatts of solar, 350GW of hydro and 110GW of wind.

In contrast, the IEA sees 151GW of solar, 65GW of wind and 434GW of hydro by 2040.

Conclusion

The World Energy Outlook is a comprehensive and valuable contribution to the energy scene, much beloved of energy geeks and policy wonks alike. Among many other conclusions, this year’s edition finds “unmistakable signs that the much-needed global energy transition is underway”.

It says that China is slowing down, that India will take centre stage and that renewables, far from being a niche source, will become the backbone of the global electricity system.

These radical visions of the future hold positive signs for successful action on climate change, even if they might be overly conservative. Yet like all forecasts they should be interpreted with due caution. The future may yet turn out to be more, or indeed less positive than the IEA expects.