China Briefing 8 August: Record extreme weather; First quarterly CO2 fall since Covid; ‘Dual control’ of carbon emissions

Anika Patel

08.08.24Anika Patel

08.08.2024 | 3:30pmWelcome to Carbon Brief’s China Briefing.

China Briefing handpicks and explains the most important climate and energy stories from China over the past fortnight. Subscribe for free here.

Key developments

Hottest month in history

RECORD HEAT: July 2024 was China’s “hottest month in observed modern history” (since records began in 1961), in a record coinciding with the world experiencing its hottest day on 22 July, Reuters reported. Every province across the country saw average temperatures for July rise year-on-year, with Guizhou, Yunnan, Hunan, Jiangxi and Zhejiang ranking highest, it said, adding that the record were unusual because “the El Nino climate pattern…ended in April, but temperatures have not abated”. State broadcaster CCTV said on 4 August that several provinces had experienced temperatures between 40-43.9C, warning residents to “reduce” time spent outdoors. Reuters also said that rising temperatures “sharply pushed up demand for power to cool homes and offices” and “stoked fears of damage to rice crops”, adding that the city of Hangzhou “banned all non-essential outdoor lighting and light shows this week to conserve energy”.

Sign up to Carbon Brief's free "China Briefing" email newsletter. All you need to know about the latest developments relating to China and climate change. Sent to your inbox every Thursday.

RECORD FLOODS: According to the state-supporting Global Times, China has “experienced 25 numbered flood events” this year, the highest number since records began in 1998. The newspaper said that, according to Ma Jun, director of the Beijing-based Institute of Public and Environmental Affairs, “[due to] global climate change, extreme weather events are increasing, which increases the difficulty of forecasting [rainfall and floods]”. Another CCTV report cited the China Meteorological Administration saying that the country experienced two typhoons and recorded “13.3% higher than average” rainfall in July. Typhoon Gaemi killed 30 people and left 35 missing in Zixing, Hunan province, Reuters said. State news agency Xinhua stated that the typhoon also caused “damage” in the coastal provinces of Fujian and Liaoning, affecting 766,900 and 60,000 residents, respectively. Xinhua reported the Chinese government called for “proactive” flood control and for “disaster relief funds [to] be allocated promptly”. The state-sponsored outlet China News said the Ministry of Water Resources issued 649m yuan ($90m) to support “flood relief” in 14 affected provinces.

New renewable energy targets and ‘green electricity’ trading policy

NEW RENEWABLE TARGETS: Regulators published provincial targets for 2024-25 under China’s renewable portfolio standards (RPS) on 2 August, reported China Power. The targets, for the renewable share of electricity supply, increased by more than 3 percentage points year-on-year in most provinces, according to analysis published by financial outlet Yicai, “compared with a 1 to 2 points jump in previous years”.

NEW ALUMINIUM TARGETS: In order to help meet the targets, regulators also issued renewable-energy goals for the aluminium industry in each province for the first time, China Power said. Reuters reported that Shandong, China’s biggest aluminium producer, is “set a target for renewables to account for 21% of the energy used to produce the metal”. The targets in Inner Mongolia and Yunnan province, which are also major aluminium producers, are set at 29% and 70%, respectively, added the newswire. China Power said that the “green electricity consumption” in the aluminium industry will be “calculated based on ‘green electricity certificates’ (GECs)” – a scheme that allows electricity generated by non-fossil fuels to be traded between producers and buyers. (See Carbon Brief’s China Briefing of 24 August 2023 for background on China’s GECs.)

‘GREEN ELECTRICITY’ TRADING: While announcing this year’s targets, the government also issued new rules for trading “green electricity” for the “medium to long term”, BJX News reported. The document says the trade via GECs should not be subject to price limits or set prices and, instead, work as a market-based system, unless “clearly stipulated by the state”. Trading should take place “mainly within provinces” with strong wind and solar resources, and can “gradually expand to other qualified renewable energy sources” when “conditions are ripe”, added the outlet.

CARBON MARKET INCLUSION: Despite an announcement in 2023 that GECs may be included in the carbon market in the future, China Power Enterprise Management magazine said that, currently, the GECs “have almost no impact on the national carbon market”, because GECs “is limited to low indirect emissions from electricity”. If energy-intensive industries are included in the carbon market, GECs can cover around 19% of carbon emissions in China, added the magazine.

No mention of reform in new power system plan

UPGRADING THE SYSTEM: BJX News reported that China has issued a plan to upgrade its power system to “promote the construction of a new type of power system” between now and 2027. The outlet said the new system should be “safe, stable, cost-effective, flexible” and support the addition of more “clean and low-carbon” resources. A “key effect” of the plan, according to the National Energy Administration, is to improve the transmission of renewable energy from the remote desert bases to cities “at a large scale”, added the outlet.

‘NEW-GENERATION’ OF COAL: Another BJX News article stated that the plan also proposes to “carry out experimental demonstrations of new-generation coal power” and explore a development path for coal “that is compatible with the development of a ‘new type’ power system”. Economic news outlet Jiemian also noted that the call to guarantee stable power supply “ranked at the top of the nine special actions outlined by the action plan”. (A new report by Ember, covered by Carbon Brief, stated that increasing investments in low-carbon energy by state-owned enterprises is pushing coal into “decline”.)

REFORM OMITTED: Reuters quoted Xuewan Chen, energy transition analyst at LSEG, saying the plan “focuses on building a more flexible power grid to better manage the [energy] transition”, but that the document did not mention “power market reform and the creation of a competitive power market to more effectively allocate resources”.

Solar industry woes continue

‘UPHEAVAL’: China’s domestic solar industry is in “upheaval” with wholesale prices falling by another 25% so far this year, after falling by almost half in 2023, the New York Times reported. It quoted Frank Haugwitz, a solar industry consultant, saying efforts by the Chinese government to rein in the industry’s expansion have been “too small to reduce China’s overcapacity”. Bloomberg said that an increasing number of Chinese solar manufacturers “are falling into restructuring or bankruptcy”, adding that “while bigger players like Longi have so far survived billions of yuan in losses by imposing production halts and layoffs, smaller companies have fewer ways to plug financial gaps”.

‘SEVERE OVERCAPACITY’: In a meeting of China’s Politburo at the end of July, state-run newspaper China Daily said, president Xi Jinping called for “strengthening industry self-regulation and preventing ‘involutional’ vicious competition”, adding that China should “strengthen the market mechanisms” to help with “inefficient production capacity”. The outlet did not report that any particular sectors were named during the meeting. Several days earlier, Bloomberg stated that Wang Bohua, head of the China Photovoltaic Industry Association, had called for “struggling solar manufacturers [to be pushed] to exit the market as soon as possible to reduce severe overcapacity”.

SOLAR SURGE: Elsewhere, BJX News reported that China added 134 gigawatts (GW) of new renewable capacity in the first six months of 2024, according to the National Energy Administration (NEA) – an increase of 24% year-on-year. It added that solar made up 102GW of the total. (Total US solar capacity stood at 139GW at the end of 2023.)

51.1%

The share of sales of “new energy vehicles” (NEVs) – which includes both battery electric vehicles and plug-in hybrids – in China in July, according to the China Passenger Car Association. The trade body added that NEV performance beat manufacturers’ expectations, which it attributed to a trade-in policy encouraging consumers to replace old cars.

Spotlight

China moves towards ‘dual-control of carbon’ with new work plan

China has released a plan that will set an absolute limit on its carbon dioxide (CO2) emissions for the first time, shifting to “dual control” of total CO2 emissions and carbon intensity instead of total energy use and energy intensity.

The document, outlining a timeline for China to construct this new system for carbon “dual-control”, will be a key element of the country’s strategy to meet its climate goals.

In this issue, Carbon Brief assesses the document’s implications for China’s future emissions targets.

Switching to dual-control of carbon

In 2016, Beijing established a set of targets for energy intensity – its energy consumption per unit of GDP – and total energy consumption, in a system known as the “dual-control of energy”.

Since 2021, the central government has called for replacing the “dual-control of energy” with “dual-control of carbon”, which would be comprised of targets for both carbon intensity and total carbon emissions. China has only ever set targets for CO2 intensity, not for total CO2 emissions.

This shift began taking shape on 2 August when the State Council, China’s top administrative body, released a “work plan” outlining the first concrete design of the new system.

The National Development and Reform Commission (NDRC), China’s primary economic planning body, told reporters at a press conference that the plan “establishes a clear direction” for developing renewable energy and “focusing on control of fossil-fuel energy consumption”.

Anticipating a 2030 peak?

According to the new plan, China aims to establish a “completed” statistics and accounting system for CO2 emissions by 2025. Components of this system include carbon footprint standards, a national database of greenhouse gas emission factors and other measurement and monitoring capabilities.

Between 2026 and 2030 – the period of the 15th five-year plan – China will replace current targets under “dual-control” of energy with a policy on “dual-control” of carbon that places “[carbon] intensity control as the main focus and control of the total amount [of carbon] as a supplement”.

This means that, under the new system, carbon intensity targets will remain binding and the cap on China’s total CO2 emissions will initially be a non-binding “supplement”.

In subsequent five-year plan periods, China will set a binding cap for total CO2 emissions, which will become the “key target” once China’s carbon peak is reached, with carbon intensity as a secondary target.

“The timeline here indicates policymakers still only aim to peak emissions by 2030, despite the clear likelihood that emissions will…peak much sooner,” Yao Zhe, global policy analyst for Greenpeace East Asia, said in a statement, adding that this shows China is still “underpromising”.

Li Shuo, director of the Asia Society Policy Institute’s China climate hub, told Carbon Brief that the ambiguity is intentional to allow policymakers “to further clarify when and how they want to make that switch [to an absolute cap]” after a peak is confirmed.

He added that policymakers’ “intrinsic inability” to predict the exact peaking timeline is the reason for setting two targets under the [new] dual-control system, as, once it happens, China “can just switch to the other [metric]”.

‘Rolling up its sleeves’

The shift from focusing on “dual-control of energy” to “dual-control of carbon” is a “change from process control to results-oriented management that will compel industries to adopt green technologies”, according to Qi Qin, China analyst at the Centre for Research on Energy and Clean Air.

China is falling short of its existing carbon intensity target, she said, making it important to “accelerate” its energy transition and clean energy buildout – priorities that are emphasised in the work plan.

Local governments are tasked with developing more specific targets, taking “local conditions” into account. Actions are also outlined for central government departments, industry associations and enterprises.

The central government subsequently released a related action plan to issue 70 national standards in areas including carbon footprints, CO2 emissions reduction, energy efficiency and carbon capture, utilisation and storage.

When formulating targets, the document urges policymakers to consider “economic development, energy security [and] normal production”, pointing to existing anxieties around maintaining stable access to power, which the country currently mostly relies on fossil fuels to provide.

Li told Carbon Brief:

“This is the Chinese government rolling up its sleeves and trying to make quite an important switch…Folks have been advocating for China to really reduce its emissions in absolute terms for almost two decades. This is the mechanics of how this will happen – them actually making this switch and trying to make sure this is done in the right way by, for example, disaggregating [targets] to the local level, getting the private sector involved and trying to build up the carbon accounting system from the bottom up.”

Implications for China’s NDC targets

As well as meeting domestic policy needs, the NDRC said, a dual-carbon control system is “conducive” to setting the country’s new international climate pledge (nationally determined contribution, NDC), and supports the image of China as “a responsible large country that is actively responding to global climate change”.

Yao said Greenpeace expects that China’s next NDC will include a carbon emission reduction goal for 2035.

Li told Carbon Brief that China’s international pledge will then drive domestic targets, due to “how the timeline works”. He added: “The NDC [target] for 2035 has to be communicated in 2025, [looking] 10 years into the future…The job of the five-year plans for the next two five-year periods [will then be] to align with that international pledge.”

Watch, read, listen

DRIVING FORCE: A report released today by Ember found that global wind capacity will double by 2030, with the majority of additions being installed in China.

SUPPORTING INNOVATION: Huang Kunming, governor of Guangdong province, wrote in the People’s Daily about the need to boost innovation to meet China’s development needs, including to “accelerate the green transformation of development”.

SUPPLY CHAINS: A Boston University Global Development Policy Center study found commercial ties between China and Latin American and Caribbean countries have broadened from solely minerals and agriculture to include the automotive, energy and transport sectors.

TACKLING METHANE: The California-China Climate Institute hosted a webinar on the state of agricultural methane emissions and bilateral cooperation between the US and China, building on a recently released report.

Captured

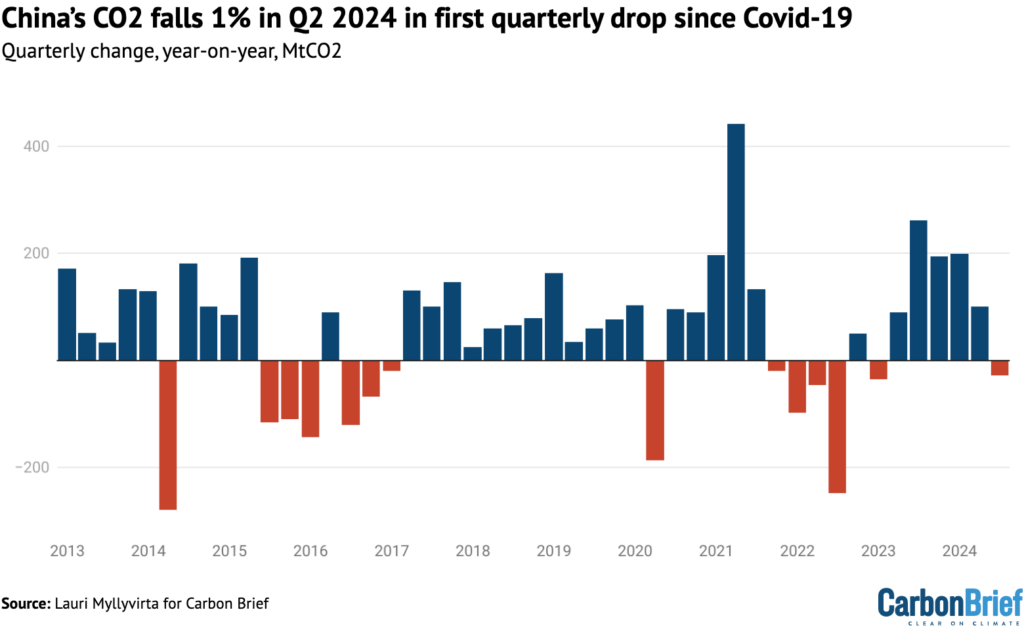

CO2 emissions in China fell by 1% in the second quarter of 2024, the first quarterly fall since the country re-opened from “zero-Covid” lockdowns, new analysis for Carbon Brief found. The reduction was driven by the surge in clean energy additions, which is pushing fossil fuel power into reverse – although the shift is being somewhat diluted by rapid energy demand growth in the coal-to-chemicals sector.

New science

The dominant warming season shifted from winter to spring in the arid region of Northwest China

npj Climate and Atmospheric Science

A new paper investigated the “seasonal asymmetry” in warming in the arid region of northwest China – which has experienced “significantly higher” warming than the global average, according to the paper. The authors used station and reanalysis data to investigate seasonal temperature changes in the region. They found that “the dominant season of temperature increase shifted from winter to spring”. The paper added that the main reason for warming in spring was a decrease in cloud cover, while a strengthening Siberian High was mainly responsible for driving winter cooling.

Carbon emissions from urban takeaway delivery in China

npj Urban Sustainability

Transport-related emissions from food deliveries in Chinese cities “surged” from 0.31m tonnes of CO2 equivalent (MtCO2e) in 2014 to 2.74MtCO2e in 2021, a new study found. The authors analysed the rise in emissions from food deliveries and explored possible policies to mitigate these emissions in the future. They estimated that by 2035, transport-related emissions from food deliveries will rise to 5.94MtCO2e. However, if motorcycles were replaced with electric bikes and traffic routes were optimised, “it is possible to mitigate such GHG emissions by 4.39-10.97MtCO2e between 2023 and 2035,” they said.

China Briefing is compiled by Wanyuan Song and Anika Patel. It is edited by Wanyuan Song and Dr Simon Evans. Please send tips and feedback to [email protected]