Autumn statement 2023: Key climate and energy announcements

Multiple Authors

11.22.23Multiple Authors

22.11.2023 | 6:07pmUK chancellor Jeremy Hunt has delivered his autumn statement, laying out plans for revitalising the economy at a time of inflation and slow growth.

As the US and the EU pour investment into low-carbon technologies and sectors in order to boost their economies, there had been hopes that the UK could take a similar approach.

Hunt promised tax cuts and “110 measures to help grow the British economy”. However, measures that directly helped to reduce emissions were relatively thin on the ground.

Significant announcements included £960m for a “green industries growth accelerator” to expand domestic low-carbon supply chains and measures to fast-track the connection of new power projects to the grid.

But experts argued that the UK would need more ambitious policies to match other nations in expanding low-carbon infrastructure.

Meanwhile, measures such as support for home insulation, which could also help cut people’s energy bills, were barely mentioned in the new statement.

- Scene setting

- Grid

- Green industries growth

- Energy efficiency and heating homes

- Levies

- Best of the rest

Scene setting

Amid on-going economic challenges, the UK has faced pressure to come up with a climate-related investment plan comparable to the US Inflation Reduction Act or the EU’s Green Deal Industrial Plan.

These strategies involve financially supporting key sectors, such as renewable energy and home insulation, in order to strengthen national competitiveness, while also boosting energy security and cutting bills.

However, while the UK’s opposition Labour party has embraced such a strategy with its proposed “green prosperity plan”, Jeremy Hunt has explicitly distanced himself from it. He wrote in the Times in March that the government would not try to compete with the US and EU on green subsidies:

“Our approach will be different – and better. We are not going toe-to-toe with our friends and allies in some distortive global subsidy race…With the threat of protectionism creeping its way back into the world economy, the long-term solution is not subsidy but security.”

The autumn statement document emphasises that “the UK will not be looking to match countries such as the US pound for pound on the back of policies like the Inflation Reduction Act”.

Instead, it focuses on incentivising private investment and what Hunt has called a “pro-growth regulatory regime”. (See: Green industries growth.)

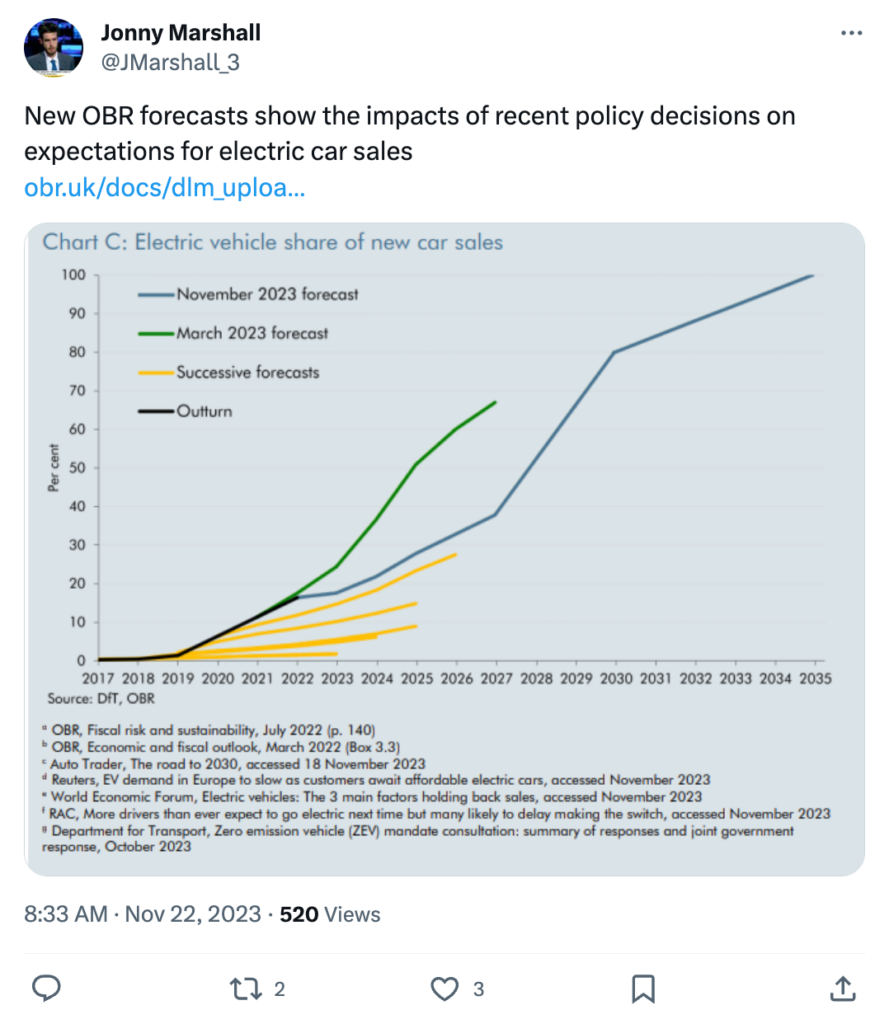

The statement comes as the UK government withdraws from some of its net-zero policies. In a speech in September, prime minister Rishi Sunak emphasised the burden net-zero placed on British people and announced a rollback of plans to phase out fossil fuel-powered cars and boilers.

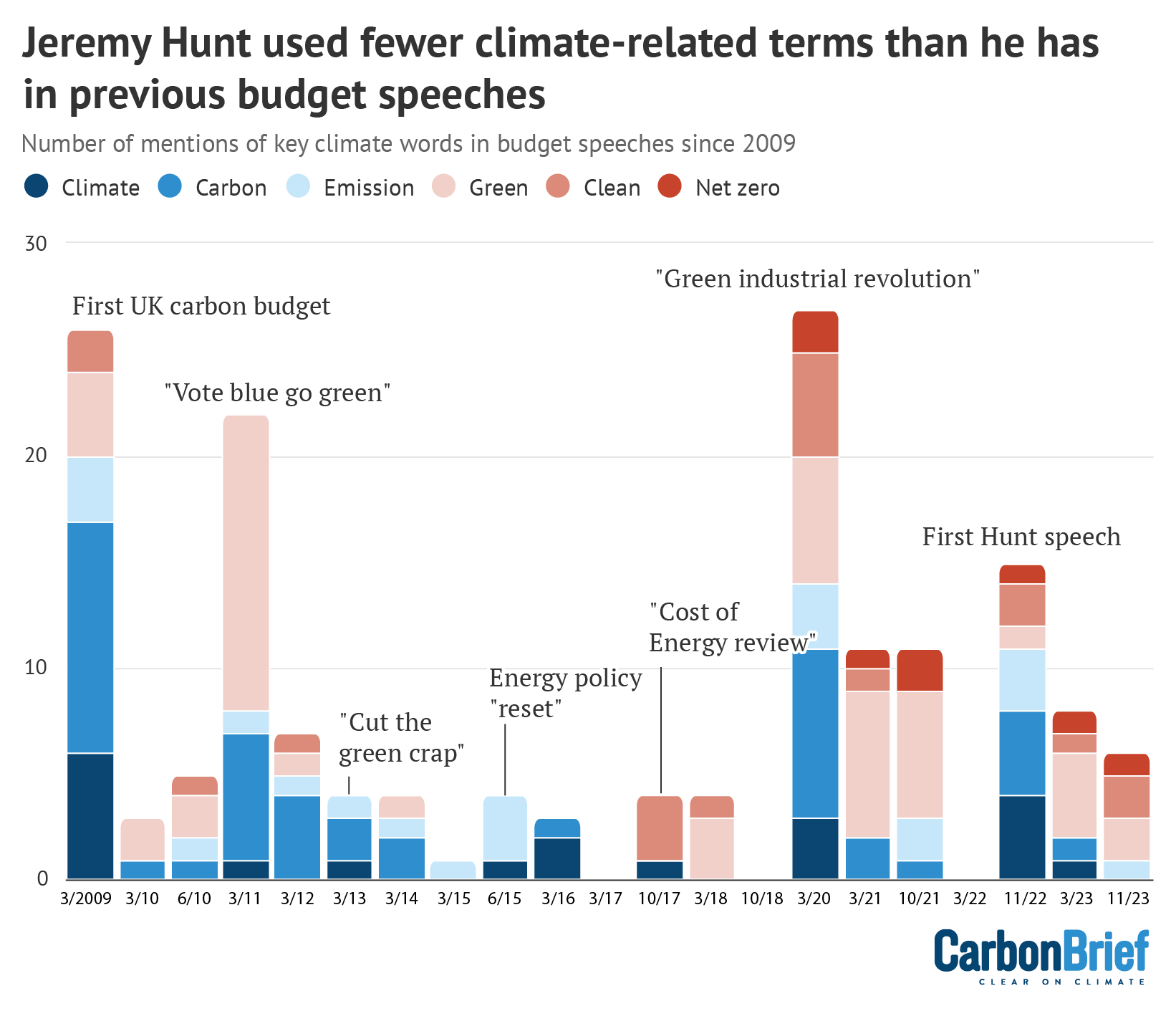

As the chart below shows, Hunt used climate-related keywords less in his latest speech than in his first autumn statement in 2022, or in the spring statement earlier this year. He did not specifically mention “climate” at all.

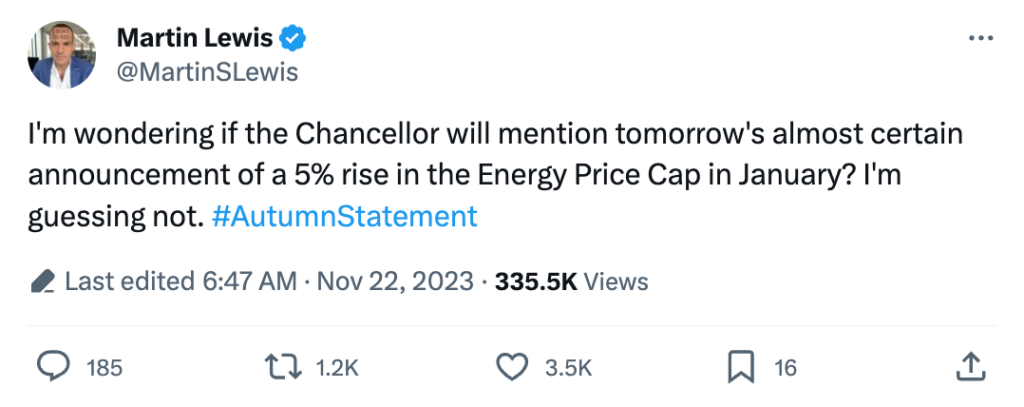

Observers also noted that there was little in the autumn statement to help people struggling to pay their energy bills.

Energy bills have doubled in three years – partly due to spiralling fossil-fuel prices amid the war in Ukraine. They are expected to rise even higher in January, with a new price cap announcement coming out the day after the autumn statement.

The government previously brought in an energy price guarantee to limit how much people would spend on their energy bills, but this expired in June.

Grid

The autumn statement included a promise to “speed up access to the national grid” through a number of measures.

Grid constraints on the island of Britain (Northern Ireland’s grid is separate) are increasingly seen as one of the biggest challenges for decarbonising the nation’s energy sector. Many renewable energy projects face a 10- to 15-year delay in gaining a grid connection.

Britain’s electricity network is aiming to be run entirely on low-carbon energy from 2035, but this could be threatened if renewable generation projects cannot connect to the grid quickly enough.

Beyond connecting renewable energy and other low-carbon energy technologies, challenges with grid connections are also holding back the expansion of industry.

Last week, the Guardian reported that the UK energy secretary Claire Coutinho could be granted powers to fast-track connecting projects to the grid, such as Tata’s planned electric battery gigafactory in Somerset.

Plans are being discussed by the government and the regulator Ofgem that would allow Coutinho to request that energy network companies accelerate upgrades to substations and power lines to connect specific developments, the article noted.

Earlier in November, Ofgem announced that it is introducing rules to remove “zombie” energy projects from the grid connection queue.

This represents a significant change from the existing “first-come, first-served” system, which has led to a queue of energy projects that could generate almost 400GW of electricity, well in excess of what is needed to power the entire energy system in Britain.

The autumn statement announced a reform to the grid connection process to cut waiting times, including “freeing up over 100GW of capacity so that projects can connect sooner”.

The change will enable the “significant majority” of projects to get their requested connection date with no wait, as well as reduce the overall connection delays from five years to no more than six months.

Additionally, the government announced an action plan, in response to the review by the electricity network commissioner, Nick Winser, within the statement. The review set out 18 recommendations designed to speed up the delivery of strategic transmission networks.

The action plan will halve the time it takes to build new grid infrastructure to seven years, the statement suggests.

The core elements of this are:

- Proposals for community benefits with up to £10,000 off electricity bills.

- Consulting on reforms to energy consenting rules in Scotland next year.

- “Committing to commission” the ESO to work with government to introduce a “strategic spatial energy plan”.

- Introducing competition into onshore electricity networks in 2024.

These actions will help to lower electricity prices, delivering an estimated net saving of £15-25 on average per household per year out to 2035, the statement notes.

Analysis published by the department for energy security and net-zero (DESNZ), reviewed by the Energy Systems Catapult and referenced within the statement, estimates that, once embedded, the grid reforms could increase investment temporarily by an average of £10bn per year over the next 10 years. This would speed up the transition to net-zero, it notes.

The autumn statement did not include a battery strategy, only noting that the government will “shortly set out more on its actions to support investment and growth in the manufacturing sector with the publication of the advanced manufacturing plan and UK battery strategy”.

Green industries growth

Jeremy Hunt reiterated the £4.5bn for strategic manufacturing sectors, including £960m earmarked for a “green industries growth accelerator”, which the Treasury announced on 17 November.

The investment is designed to support the expansion of “strong, home-grown, clean energy supply chains”, including carbon capture, utilisation and storage, electricity networks, hydrogen, nuclear and offshore wind.

This will “enable the UK to seize growth opportunities through the transition to net-zero, building on our world-leading decarbonisation track record and strong deployment offer,” the government’s statement notes.

The investment was welcomed by the renewable industry, with trade association RenewableUK’s chief executive Dan McGrail saying in a statement:

“The chancellor has been clear that the green industries growth accelerator is for strategic industries, targeted to unlock maximum private investment where the UK can be competitive – and there couldn’t be a better fit for that than offshore wind and renewables. With the right support, the likes of which we’ve seen from government today, industry estimates that the offshore wind supply chain alone could boost the UK’s economy by £92bn by 2040.”

The fund will sit alongside the range of long-term deployment support set out in Powering Up Britain, published in March, which will “ensure the government delivers the clean energy transition and boosts green investment and job creation across the country”, the statement notes.

Within the autumn statement, the next set of investment zones are named, including the East Midlands, which will have a focus on green industries and advanced manufacturing. This is expected to help leverage £383m in private investment and create 4,200 jobs in the region over the next 10 years, it says.

Beyond this, the autumn statement announces permanent full expensing, including the 50% first-year allowance for special rate assets. This applies across the economy, with the statement highlighting the impact on capital-intensive, low-carbon industries, such as solar and offshore wind.

Additionally, permanent full expensing can support companies looking to decarbonise by investing in solar panels and heat pumps, as well as “greener” machinery, the statement notes.

Reacting to this, Rachel Solomon Williams, executive director at the Aldersgate Group, said:

“We welcome the announcement that capital full expensing will be made permanent, as it can drive business investment in decarbonisation – but it is not enough on its own. This urgent need for action is demonstrated in clean energy investment, where the UK has fallen from fourth to seventh in attractiveness to investors, in part due to global competition from the US and the EU, but also a lack of consistent policy support from the government.

“A comprehensive response to the US Inflation Reduction Act remains critical, as part of a clear industrial strategy which provides the UK economy with a clear direction that businesses can rely on.”

The autumn statement also mentions the Industrial Energy Transformation Fund (IETF), which provides funding to support industrial sites to invest in more energy efficiency and low-carbon technologies.

IETF was initially announced in the 2018 budget, with £315m of funding made available up until 2027 at the time. The fund is now into its third phase, with the £185m – mentioned in the autumn statement – announced in March 2023.

This funding will come from the £6bn announced in the autumn statement in 2022, to support energy efficiency from 2025. Further allocations are set to come out “in due course”, the 2023 statement notes.

Under the six-year Climate Change Agreement scheme, set to start in 2025, the government is providing around £300m a year in tax relief in exchange for meeting energy efficiency targets. Additionally, it is expanding VAT relief available on the installation of energy-saving materials in residential buildings or those used solely for a relevant charitable purpose.

In addition to the focus on offshore wind as a strategic sector, the autumn budget outlines plans to bring forward legislation to provide the Crown Estate with borrowing and wider investment power “as soon as parliamentary time allows”.

This will help to unlock a further 20-30GW of offshore wind seabed rights by 2030, the statement notes.

The government is also working with the Crown Estate to bring forward additional floating wind in the Celtic Sea through the 2030s, which has the potential to see 12GW of generation deployed.

This would be alongside the 4.5GW auction round due to open soon, which has the potential to deliver £20bn in direct employment, the statement says.

Energy efficiency and heating homes

There have been persistent calls for the government to scale up support to help people insulate their homes.

The UK has some of the least efficient housing in Europe. Improving this situation would cut emissions, reduce reliance on fossil-fuel imports and save billions on people’s energy bills.

In last year’s autumn statement, Hunt pledged £6bn of new government funding between 2025 and 2028 to improve energy efficiency in households, businesses and the public sector. He also announced the formation of a new energy efficiency taskforce to help deliver “energy efficiency across the economy”.

Since then, there has been little information about the new funding and the taskforce was scrapped in September, amid the government’s rollback of net-zero policies.

Sunak also withdrew a policy that would have required landlords to improve the efficiency rating of their rental properties by 2028. This continued a long trend of Conservative governments announcing home-insulation schemes and then scrapping them.

Ahead of this year’s autumn statement, various MPs, housebuilders, charities and climate experts said Hunt should prioritise retrofitting people’s homes. Among the measures proposed were widening access to insulation schemes and more long-term clarity on how existing funds would be spent.

The Daily Telegraph reported on a plan to give new homeowners some of their stamp duty money back if they insulated their houses within two years of moving in. According to the newspaper, this idea was “in the running” for Hunt’s statement.

Expert groups and thinktanks also recommended new financial incentives to encourage landlords to insulate their homes.

In the event, there was very little in the statement on home energy efficiency. The only mention of the £6bn fund was a chunk that would be allocated for industrial sites. (See: Green industries growth.) Juliet Phillips, a senior policy adviser at the thinktank E3G, tells Carbon Brief:

“Our analysis suggests that £6bn would barely cover the costs of domestic retrofit, let alone industrial energy efficiency as well. The mammoth task of improving the UK’s leaky homes can’t be underfunded; and we’d encourage additional funding to be put aside to support industry.”

There was more on decarbonising heating, following on from Sunak’s recent announcement that he would increase grants under the boiler upgrade scheme from £5,000 to £7,500, in order to incentivise the switch from fossil-fuel boilers to electric heat pumps.

The government says it will launch a consultation into changing planning regulations to “end the blanket restriction on heat pumps one metre from a property boundary in England”. It adds that this will “reduce delays”.

It also commits to expanding the VAT relief available on the installation of energy-saving materials to additional technologies, including water-source heat pumps.

Levies

The autumn statement confirmed the energy profits levy will end no later than 31 March 2028. This was brought in in 2022 in response to the enormous profits made by oil-and-gas majors due to the elevated global price of fossil fuels.

It was initially set at 25%, before being raised to 35% by Hunt during the autumn statement in 2022.

Within the autumn statement, an investment exemption for the electricity generator levy has now been introduced.

The windfall tax was introduced during the spring budget 2023, applying a 45% levy on electricity generators who have made excess profits amid high power prices.

Since its introduction, the energy sector has been calling for the introduction of investment allowances, which allows generators to re-invest tax expenditures into low-carbon technologies.

An investment allowance was always included in the energy profits levy, a move that trade body Energy UK said sent the “wrong signal to investors”, as oil-and-gas extraction would face “a lower rate of effective tax than low-carbon generators”.

New electricity generation stations or expansions of existing generation assets made on or after 22 November 2023, will now not be subject to the levy. The electricity generator levy is also set to end on 31 March 2028.

The government is going to freeze main and reduced rates of climate change levy in the UK in 2025-26, the autumn statement notes.

As such, the levy for electricity and gas will be frozen at £0.00775/kWh, liquid petroleum gas (LPG) at £0.02175/kWh and any other taxable commodity at £0.06064/kWh.

Reduced rates will be frozen at 92% for electricity, 77% for LPG and 89% for gas and any other taxable commodity, it notes.

Alongside the autumn statement, the government has published the conclusion to the review of the oil and gas fiscal regime, as well as set out the final design of the energy security investment mechanism. This includes future adjustments to the mechanism’s price thresholds in response to inflation.

This package will “provide certainty and predictability for investors and operators in this crucial industry in the short-, medium- and long-term”, the statement notes.

Best of the rest

Beyond these key energy and climate announcements, the autumn statement also saw reforms to the emissions trading scheme (ETS) (page 73, point 4.62).

These were set out in July 2023 and will reduce the number of ETS permits available for purchase from the government by 45% between 2023 and 2027, the statement notes.

Additionally, the scheme will be extended to cover emissions from domestic maritime and energy from waste in 2026 and 2028, respectively, marking an “important step in achieving net-zero ambitions”.

The autumn statement also announced that the government will look to remove unnecessary planning constraints by accelerating the expansion of the electric vehicles (EV) charging infrastructure.

This builds on actions laid out already in the government’s EV infrastructure strategy, which set out the government’s EV vision for 2030.

The government will consult on amending the national planning policy framework to prioritise the rollout of EV charge points, including EV charging hubs, the statement says.

As of the end of October 2023, there were 51,516 EV public charging points across the UK at 30,360 charging locations, according to charging services provider Zapmap. This was a 45% increase in the number of charging devices since October 2022.

With sales of EVs continuing to surge in the UK, charging infrastructure will need to keep pace, to facilitate the transition from petrol and diesel vehicles.

Despite pressure from the Treasury to raise fuel duty, the autumn statement left it frozen at 57.95p, the same level it has been at since 2011. Fuel duty was only mentioned once in the autumn statement, in reference to the drop in inflation.